In today’s fast-paced digital environment, businesses in Singapore require secure and efficient document management solutions. Whether you’re involved in mergers and acquisitions (M&A), legal processes, investment banking, or corporate audits, setting up a data room is a crucial step to safeguarding sensitive information.

A data room is more than just cloud storage—it is a highly secure digital repository that enables authorized users to access and share confidential files while ensuring full compliance with Singapore’s data protection laws. Without a proper setup, businesses risk data breaches, inefficiencies, and non-compliance—all of which can lead to severe financial and reputational damage.

In this guide, we will explore:

✔ The role and importance of a data room for Singaporean businesses

✔ A step-by-step guide to setting up a data room efficiently

✔ Best practices for security, document management, and compliance

✔ A comparison of top virtual data room providers in Singapore

If your business handles confidential data, understanding the right approach to setting up a data room will help you improve security, efficiency, and regulatory compliance.

Understanding Data Rooms and Their Importance

What is a Data Room?

A data room is a highly secure online storage system used to manage, store, and share business-critical information. Unlike general cloud storage services, data rooms provide advanced security measures, controlled access permissions, and compliance tools, making them the ideal solution for managing legal, financial, and corporate records.

Why Singaporean Businesses Need to Set Up a Data Room

Singapore, as a leading financial and investment hub, is home to many private equity firms, investment banks, and multinational corporations. With strict regulations under the Personal Data Protection Act (PDPA), businesses must ensure secure data handling and compliance when storing or sharing sensitive information.

By setting up a data room, businesses can:

✔ Enhance data security with encryption and controlled access

✔ Streamline collaboration between internal teams and external stakeholders

✔ Improve efficiency with structured document management

✔ Ensure compliance with Singapore’s regulatory requirements

Industries That Benefit from Setting Up a Data Room

A well-structured data room setup is essential for companies involved in:

- Mergers & Acquisitions (M&A) – For due diligence and transaction documentation

- Legal Services – For case files, contracts, and regulatory compliance

- Investment Banking & Financial Services – For investor reports and risk assessments

- Private Equity & Venture Capital – For portfolio management and investor communication

- Real Estate Transactions – For lease agreements and transaction records

If your company operates in any of these sectors, setting up a data room is a strategic move that will optimize security and operational efficiency.

Step-by-Step Guide to Setting Up a Data Room

1. Determine the Purpose of Your Data Room

Before starting the setup, clearly define the purpose of your data room:

- Are you managing an M&A deal, an investment round, or internal corporate records?

- How many users will require access?

- What security and compliance measures are necessary?

- Do you need collaboration features like Q&A sections and version tracking?

Defining these factors will help you select the right data room provider and features.

2. Choose a Secure and Reliable Data Room Provider

A secure data room provider ensures that your confidential information remains protected. When selecting a provider, prioritize:

✔ ISO 27001 & SOC 2 Type II certification for maximum security

✔ Multi-factor authentication (MFA) to prevent unauthorized access

✔ End-to-end encryption for safeguarding documents

✔ Granular permission settings for controlled file access

✔ Activity tracking & audit logs to monitor user actions

Top Data Room Providers in Singapore

Several virtual data room providers offer services tailored to Singaporean businesses. The most trusted options include:

- iDeals – Best for M&A and legal teams

- Firmex – Preferred by financial institutions

- Intralinks – Ideal for large-scale corporate transactions

- Datasite – A top choice for private equity and venture capital firms

Choosing the right provider is a key step in setting up a highly secure and efficient data room.

3. Structure Your Data Room for Easy Navigation

A well-organized data room helps businesses retrieve documents quickly and avoid errors. Follow these best practices when setting up your file structure:

- Use Hierarchical Folders: (e.g., Financials > Audits > Q1 Reports)

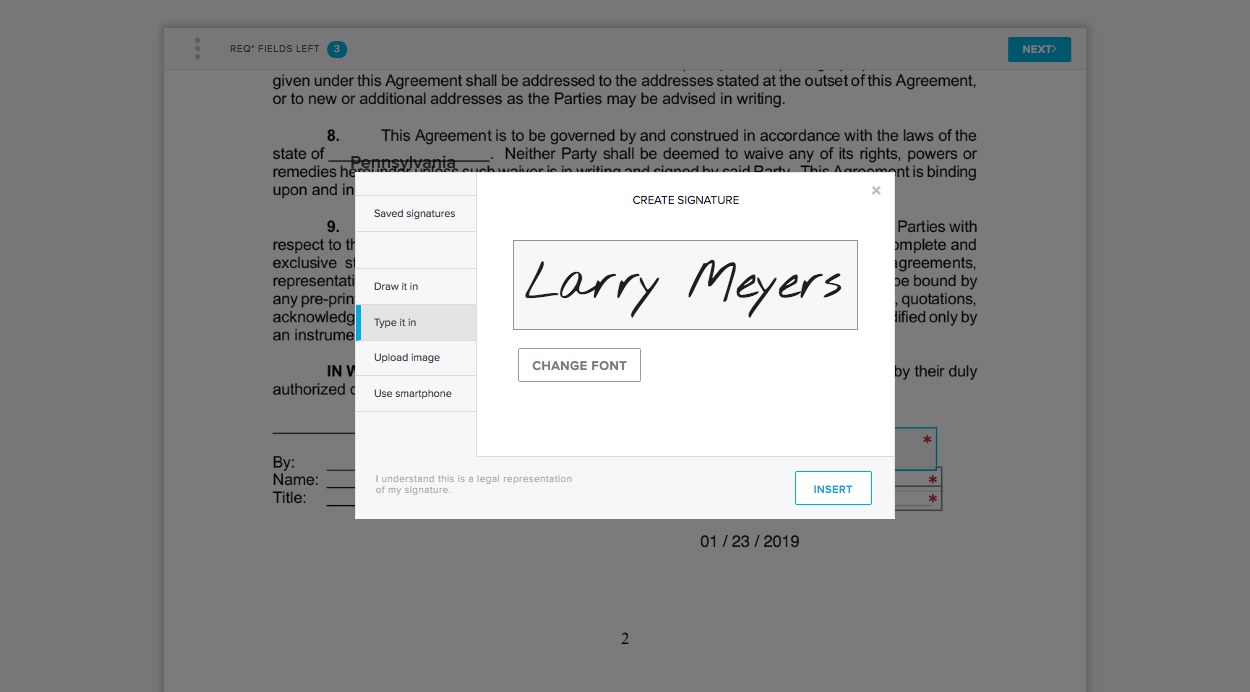

- Maintain Consistent File Naming: (e.g., “Agreement_ClientName_2025.pdf”)

- Separate Internal & External Access Files

- Implement Version Control to track document edits

A structured data room setup ensures that users can find what they need quickly and securely.

4. Set User Access Permissions & Controls

Not all users need access to all files. Setting role-based permissions prevents unauthorized access while ensuring smooth operations.

✔ Read-Only Access – For investors and external partners

✔ Limited Editing Access – For managers handling document updates

✔ Full Control – Reserved for administrators and legal teams

Pro Tip: Enable Multi-Factor Authentication (MFA) and watermarking to track document sharing and prevent leaks.

5. Ensure Security & Compliance Measures

Security is the foundation of a data room setup. Follow these best practices:

✔ Activate automatic encryption for stored and shared documents

✔ Set up watermarking to deter unauthorized distribution

✔ Conduct regular security audits to maintain compliance with PDPA

✔ Use real-time alerts to detect unusual access patterns

By implementing these security protocols, your data room remains fully protected against cyber threats and compliance risks.

Best Practices for Managing Your Data Room Efficiently

- Regularly update and archive old documents – Remove outdated files to avoid confusion.

- Use AI-powered search tools – Quickly locate specific contracts, reports, or financial statements.

- Enable activity tracking – Monitor who accessed which document and when.

- Maintain a backup plan – Store critical data in redundant locations to prevent loss.

- Educate users on data security – Ensure all team members follow best practices for handling confidential information.

Final Thoughts: The Future of Secure Data Management

A properly structured data room is essential for businesses dealing with sensitive documents, high-value transactions, and regulatory compliance. Whether you’re managing an M&A deal, investment round, or legal case, setting up a secure, efficient, and compliant data room ensures smooth operations and data protection.

If you’re ready to set up a data room for your business in Singapore, start by selecting a trusted virtual data room provider and following the best practices outlined in this guide.